Local Investors Should Quote Local Hard Money for Fix and Flip Loans,

as National Players Drive Online Competition Up, and ROI Down

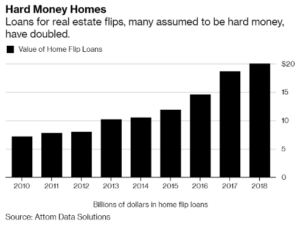

Today’s fix-and-flip market is the hottest it’s ever been, with flips as high as 11% of the total residential market in Q4 of 2018, so the lending market for funding the flip is becoming as diverse and competitive as that of the investors. Rapidly growing numbers of private, ‘hard money’ lenders are setting up shop via internet to meet increasingly more fix-and-flip prospectors in the online marketplace.

Meanwhile, lenders and investors are both challenged in today’s cyber market by a competing segment of “iBuyers” (initially Open Door and Offer Pad, now joined by such bigger players as Zillow, Keller Williams and Goldman Sachs); these are self-funded investor organizations staking their claim on the quick-turn flips, stating that they’re not flipping houses but expediting the buy-and-sell process of the residential real estate market. iBuyers are buying houses online with quick cash at appraised value, so the sellers have ready capital for the next purchase, and then the iBuyer does a quick clean-up job to sell the house at a thin gain. The traditional fix-and-flip investor, and the traditional hard money lender for the flip, are both getting squeezed out of the expanding iBuyer market for the quickest, “paint and carpet” flips.

Meanwhile, lenders and investors are both challenged in today’s cyber market by a competing segment of “iBuyers” (initially Open Door and Offer Pad, now joined by such bigger players as Zillow, Keller Williams and Goldman Sachs); these are self-funded investor organizations staking their claim on the quick-turn flips, stating that they’re not flipping houses but expediting the buy-and-sell process of the residential real estate market. iBuyers are buying houses online with quick cash at appraised value, so the sellers have ready capital for the next purchase, and then the iBuyer does a quick clean-up job to sell the house at a thin gain. The traditional fix-and-flip investor, and the traditional hard money lender for the flip, are both getting squeezed out of the expanding iBuyer market for the quickest, “paint and carpet” flips.

Catch Up on the Brief History of the “iBuyer” Market Through These Articles

- The May 22, 2018 Housing Wire article by Ben Lane features the entrance of Zillow and Goldman Sachs joining other real estate players, such as Open Door and Offer Pad, expanding the “iBuyer” market, chasing the unprecedented growth of fix-and-flip investments.

- This April 23, 2019 MarketPlace article by Amy Scott Announces Keller Williams entering the iBuyer market.

- Analysts continue to follow Zillow’s iBuying venture, called “Zillow Offers,” with this Wall Street Journal article, May 9, 2019, reporting that Zillow’s fix-and-flip revenues were now topping $120 million, and though losses still exceeded $40 million, the 50% year-over-year revenue growth earned 19% stock gains for Zillow.

Why Do the New Fix and Flip Market Trends Suggest Local Lending for the Local Investor?

This recent June 12 Bloomberg article by Michael Sasso is worth a read at this transformational juncture in the history of fix-and-flip real estate investment. According to the article, flip activity appears to be slowing, and average ROI appears to be dropping. On the surface, this is discouraging to the independent residential real estate investor. However, with the ibuyer market quickly expanding, and with hard money lending inherently difficult to measure (as noted by Sasso), definition of change at the national level is difficult, if not deceiving. Let’s look at the major market shifts and their investment implications for the traditional, local, independent, fix and flip investor:

This recent June 12 Bloomberg article by Michael Sasso is worth a read at this transformational juncture in the history of fix-and-flip real estate investment. According to the article, flip activity appears to be slowing, and average ROI appears to be dropping. On the surface, this is discouraging to the independent residential real estate investor. However, with the ibuyer market quickly expanding, and with hard money lending inherently difficult to measure (as noted by Sasso), definition of change at the national level is difficult, if not deceiving. Let’s look at the major market shifts and their investment implications for the traditional, local, independent, fix and flip investor:

- If the fix and flip market by definition of the new iBuyer segment is no longer including the “paint and carpet” jobs, the remaining market of the more rehab-intensive flips will appear to be a shrunken fix and flip market overall.

- The iBuyers are paying higher prices for the quick flips than the independent investors would have likely negotiated, and selling for thin margins at high volumes. This alone brings the overall residential real estate investment market ROI down. The remaining fix and flips, with longer flips and higher rehab costs, are at higher risk of lower ROI, especially with more inexperienced investors handling them.

- As pointed out by Sasso, many of the new lenders enter the market at the highest rates, and not offering to fund more than 70% of the purchase price on the investment property. There are fewer investors, especially newcomers, who can afford to put 30% down. Keep in mind that more of the new lenders are transacting virtually by internet, so they have to cover their risks of unknowns with higher rates and lower coverage of the purchase. These higher costs of entry tend to slow down the pace of the rehab-intensive flips.

The point of suggesting local hard money for local fix and flips is within the context of observing the explosive growth of the iBuyer market, and projecting that this growth will continue to displace local investors from the quick and easy, “paint and carpet” segment of the market. In the remaining fix and flip market of more labor-intensive rehabs, local private investors would do well to at least quote the established, local private hard money lenders, in comparison with the national lenders. The quote-local suggestion is also advised considering the market context described in the Sasso article, where the new lenders are entering the market with high rates and low coverage of the investment property purchase price. The local lenders know their market and are more likely to cover 90% of purchase price, 100% of rehab costs, with competitive rates. Add the advantage of joining local Real Estate Investment Associations, while networking with local realtors, and the local collaboratives can likely achieve their highest collective ROI’s and offer the lowest cost of entry at least risk to new investors.

MM Lending is a local, private, residential real estate lender dedicated to a fast and simple lending process in Louisville, Cincinnati and Indianapolis. Pioneers in successful, fix-and-flip funding since 2005, we have been investors as well as lenders through the extreme highs and lows of real estate, so we know the investment neighborhoods (and your investment opportunities) better than the national lenders. Seasoned investor? MM Lending will compare favorably to your lending experience. First-time fix-and-flip? You’ll find MM Lending to be as helpful as we are fast and simple.

Give Mike or Wendy a quick call at 502-400-3011, or Contact Us here, or request your 24-Hour Free Pre-Approval here, in less than 2 minutes, and if pre-approved, you can move quickly on your next flip property to close in as little as 7 days . We look forward to discussing your investment property and being your dependable lender.